Candlestick chart reading is very important to understand the behavior of price i.e Price action. In today’s marketplace, many traders like to choose or rely on someone else to trade or invest. Gaining knowledge will prove to be the best investment an individual ever makes.

So start gaining knowledge for your better trading experience. In this article, I discussed the concept of a candlestick in the way how I see a candle on a chart.

The following points will be covered

- What is a candlestick?

- Component of the candlestick?

- The types of candlesticks in my way?

- What does a candlestick indicate?

- Which type of candle is important?

- Why candlestick chart is so popular?

After go through this article you will get a clear concept of to read price by candlestick chart.

What a candlestick is?

A candlestick on a candlestick chart is nothing but only the visual representation of the Price of a security/asset i.e stocks, index, derivatives. It represents several pieces of information about the price movement of an asset over a specific time period.

Components of Candlestick:

In a particular timeframe, a candle has the following components-

- Opening price: the price level at which the first transaction has been made between the buyer and seller of that fixed timeframe.

- Closing price: This is the price level at which the last transaction has been made between the buyer and seller of that fixed timeframe.

- High price: The price level is the highest price (maximum) of the total transactions made during that particular time frame. The high price is the price that the last buyer has bought (made a transaction) from the seller. After that buyers were not ready to buy at a higher price i.e demand decreased.

- Low price: This is the lowest price level of total transactions made during that particular time frame. Low price is the price where the last seller has sold (made a transaction) to the buyer. After that sellers were not ready to sell at a lower price i.e Supply decreased.

During this process price makes three important zones which are also part of the candle.

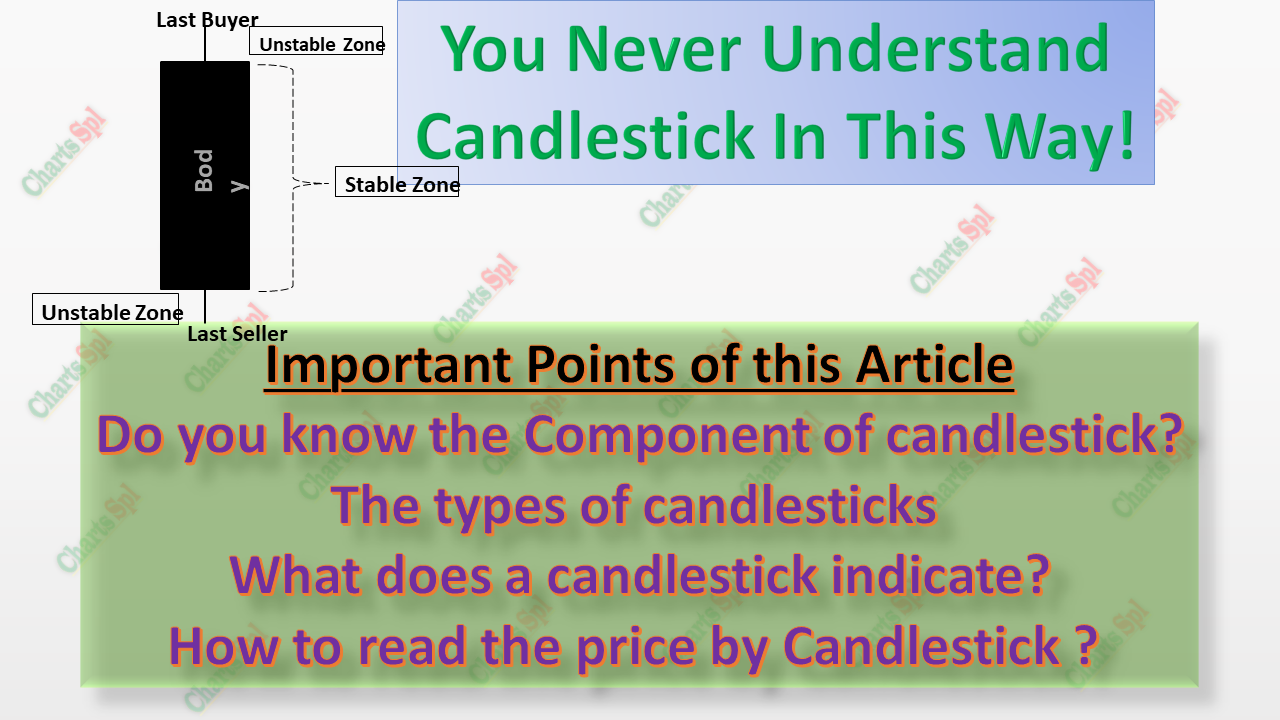

- Unstable Zone (Upper):– in a particular timeframe after opening suppose the price has made a high and closed below that high price but above the opening price then the zone from high price to close price is termed as the Upper unstable zone i.e upper wick and candle is formed green colored as close is greater than open. ( Ref the pic)

- Unstable zone (Lower): Similarly, a lower unstable zone is also formed during a particular time frame.

- Stable Zone: This is the price zone between opening and close.

Note: When Close price > open price=> Green Candle formed, indicates buyer dominating

When Close price <Open price => Red Candle formed, indicating seller dominating.

Types of Candlesticks

Types of Candle: keeping the above points in mind there are only two types of candles that exist in the market.

- Healthy Candle: A candle which has all the above 7 components i.e Open, Close, High, Low, Upper & Lower Unstable zone and Stable Zone.

- Unhealthy Candle: A candle missing anyone out of seven components is an Unhealthy Candle. (Picture)

What does a Candlestick indicate?

The body/Stable Zone of the candlestick represents the opening and closing prices of the stock during the period, with different colors indicating whether the closing price was higher or lower than the opening price.

A white or green body typically indicates a bullish or positive sentiment, while a black or red body typically indicates a bearish or negative sentiment.

The upper and lower unstable zones of the candlestick represent the high and low prices reached during the period, respectively. These unstable zones can provide additional information about the trading activity and sentiment during the period, such as whether there was significant volatility or buying/selling pressure.

In the chart, candlesticks are the footprints of market activity in the past. From these footprints, we can find a way/road to follow and also predict future price movement. Yes, we can only predict the price behavior not guaranteed, remember that “ The Market is Always Right” and always expect the unexpected, anything can happen in the market.

These candlesticks are formed a price pattern and structure which may follow in the future or may it fail. Overall, candlestick charts are a popular tool used by traders to analyze price trends, identify potential buying or selling opportunities, and make informed trading decisions.

Which type of candle is important?

Now you know that there are two types of candles formed in the chart. A healthy candle consists of all the information of a particular time period. It has open, high, low, close, stable, and unstable zones .trader can take a firm decision by using this information.

These price zones are acts as a support and resistance where the price naturally reacts. ( Ref the Pic for better understanding)

But in unhealthy candles, information is missing therefore for the trading decisions it has no use.

Candlestick charts are popular because they offer several advantages over other types of charts, including:

Clarity: Candlestick charts are easy to read and interpret, providing a clear picture of price movements over time.

Comprehensive: Each Candlestick provides a lot of information in a single chart, including the open, close, high, and low prices for a given period and the color and shape of the candle can quickly convey whether the market is trending up or down.

Predictive: Candlestick patterns can be used to predict future price movements, making them a valuable tool for traders.

Historical: Candlestick charts provide a historical record of price movements, allowing traders to analyze past trends and make informed decisions about future trades.

Candlestick charts also provide insight into market sentiment and can be used to identify patterns that can be used to make trading decisions.

****Thanks for giving time to gain knowledge. I hope this will add value in your trading practice. All the best for your successful trading carrier.******-Charts Special.